The Government of India introduced the PAN 2.0, the upgrade version of the PAN card with QR code to create a fully paperless and online system in India. All taxpayers are eligible to obtain PAN 2.0.

Know all about the PAN 2.0 details, PAN card 2.0 features, PAN card 2.0 QR code, PAN card 2.0 benefits, PAN card 2.0 eligibility and PAN card 2.0 apply.

What is PAN 2.0?

On 25 November 2024, the Cabinet Committee on Economic Affairs (CCEA) approved the PAN 2.0 Project of the Income Tax Department with a financial outlay of Rs. 1,435 crore. PAN card 2.0 is an e-governance project to re-engineer the taxpayer registration services process through a technology-driven transformation of PAN or TAN services. It aims to provide taxpayers with a seamless, enhanced digital experience.

PAN 2.0 is a comprehensive upgrade to the Permanent Account Number (PAN) system, which will integrate core and non-core PAN or TAN services and PAN validation services into a paperless, unified platform, aligning with the government’s Digital India programme.

The PAN 2.0 project resonates with the government’s vision enshrined in Digital India by allowing PAN to be used as a common identifier for all digital systems of specified government agencies. It is expected to cater to the business’s demands, focus on effective grievance redressal, and give better cybersecurity.

F&O Losses? Don’t Let Them Go to Waste.

Auto-apply set-offs & carry forwards, so you get max refund.

Key Features of PAN 2.0

- PAN Card Upgradation: PAN 2.0 initiative will update the current PAN system/ framework with modern, advanced technology to improve operational efficiency.

- QR code: The PAN card 2.0 will integrate QR codes, enabling verification of the PAN holder’s details and confirm the card’s authenticity. The unique QR code will store the PAN holder’s important details in a digital format.

- Single Platform: A single unified digital platform will consolidate all PAN-related services, enabling easy access to users for managing their accounts.

- Easier Verification Process: By integrating PAN with Aadhaar, the QR code makes KYC verification more secure, reducing manual checks, and paperwork.

- Data Security: Cybersecurity measures will be improved and strengthened to safeguard taxpayer data against unauthorised access and breaches.

- Storage: A PAN data vault will provide secure storage systems for entities using PAN-related data.

Benefits of New PAN Card 2.0

- Enhanced Security Measures: The QR code on PAN 2.0 can only be scanned and read using authorised software. This keeps your data safe, reduces the chances of misuse, and helps prevent duplicate or fake PAN cards.

- Dynamic and Encrypted: The QR code securely stores encrypted personal details like PAN number, name, date of birth, and Aadhaar, having real-time digital verification, helping minimise fraud.

- Instant Generation: With Aadhaar authentication, the e-PAN is generated instantly, cutting down on wait time and making the process much faster and more convenient.

- Eco-Friendly Format: PAN 2.0 promotes paperless operations. Since the process is entirely digital, there’s no need to print or carry physical cards, which is both efficient and environmentally conscious.

- Global Accessibility: NRIS and OCIS can apply for and receive their e-PAN online from anywhere. This makes financial and compliance processes easier, regardless of location.

Eligibility Criteria for PAN 2.0

- You must be an existing PAN holder, only eligible for a PAN 2.0.

- If you apply for a PAN card, you are also eligible for a PAN 2.0.

- You must provide documents for proof of identity, address and date of birth.

Documents Required for PAN 2.0

To apply for PAN 2.0, you must provide one document from each of the following categories:

| Type of Document | Accepted Documents |

| Proof of Identity | Aadhaar CardPassportDriving LicenseVoter ID Card |

| Proof of Address | Bank Statements from the last 3 monthsRent AgreementUtility Bills from the previous 3 monthsAadhaar Card with current address |

| Proof of Date of Birth | Birth CertificateSchool-Leaving CertificatePassport |

Loss in Trading ≠ Loss in Tax Refund.

Auto-apply set-offs and carry forwards, ClearTax does it all.

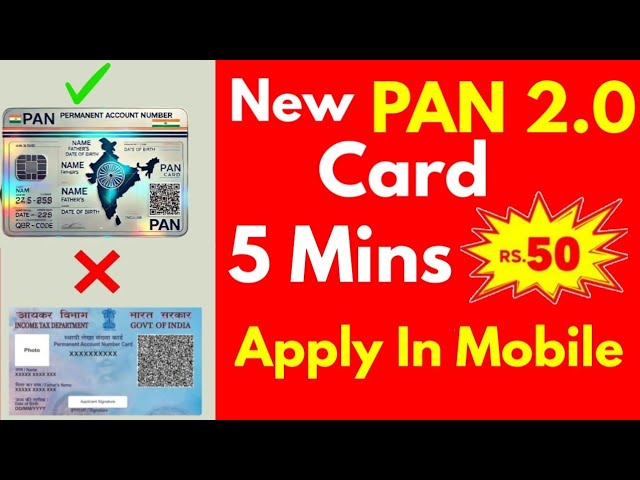

Changes/ Upgrades From Existing PAN Card to PAN 2.0

PAN 2.0 introduces enhanced functionalities in the existing PAN card. One prominent update in the existing PAN card is the QR code feature, which facilitates easier data access, verification and quicker eco-friendly services. The PAN 2.0 will contain a QR code for quick scans.

The upgrade from the existing PAN card to PAN 2.0 will streamline taxpayer registration and verification through a paperless and secure digital system. However, the existing PAN cards will remain valid. Citizens having a PAN card need not apply for a new PAN card 2.0. They can upgrade their existing PAN card to PAN 2.0 with new QR code features at no additional cost.

You can change or upgrade your existing PAN card to PAN 2.0 through the NSDL or the UTIITSL website. The below section covers the detailed process to update PAN card to PAN card 2.0 online.

How to Apply for PAN Card 2.0?

When you do not have an existing PAN card, you can change from your existing PAN card to PAN 2.0 through the NSDL or the UTIITSL website. Here is the process to apply for new PAN card 2.0.

Pan Card 2.0 Apply Online Through NSDL Website

Step 1: Visit the NSDL website.

Step 2: Enter your PAN number, Aadhaar number, and date of birth.

Step 3: Verify your information, tick the checkboxes and click ‘Submit’.

Step 4: Choose the method to receive the one-time password (OTP) and enter it within 10 minutes.

Step 5: Agree to the terms, select your payment mode and proceed with the payment. It is free if you make the request within 30 days of PAN issuance for up to three requests. Beyond 30 days, you will have to pay a fee of Rs.8.26 (including GST).

Step 6: The e-PAN will be sent to your registered email ID within 30 minutes of processing payment.